A voucher is a written document that provides information about the accounting of the transaction and its accuracy. This redeemable bond can be used only on a few terms and conditions on particular goods.

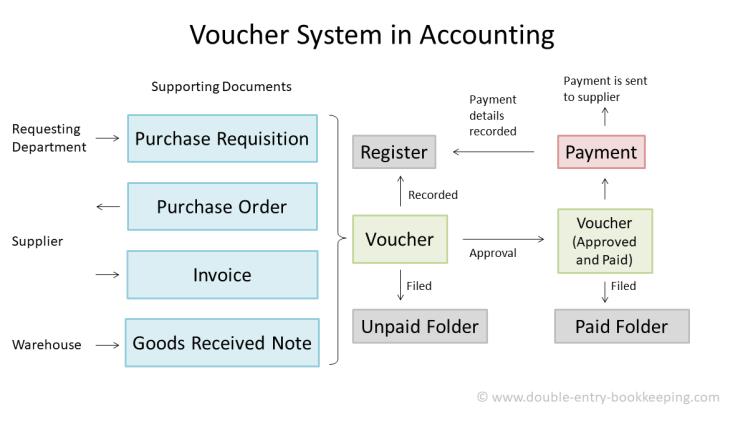

Such a voucher is created after the supplier receives an invoice for payment. If you wish to know more about what is a debit note, you can click here to know more. After the transaction is completed, it gets a stamp of approval after which the voucher gets archived. There are 4 different types of accounting voucher

- Debit/Payment Voucher

- Credit/Receiver Voucher

- Journal Voucher or Transfer Voucher

- Supporting Voucher

Importance of Accounting Vouchers

The significance and importance of accounting vouchers are explained as follows:

- It retains all pieces of evidence for a particular transaction.

- Many account books are created by using accounting vouchers as the foundation.

- The auditor can effortlessly enter the voucher accounts in the cash book and complete his other duties.

- It can be used as a backup for all payable accounts.

- The payment run mechanism helps to find unpaid vouchers.

- It guarantees the completion of each payment and its authorization.

- Checking the status of the goods and services gets simplified.

- The nature, description, date of transaction, the paid amount and supplier name can be verified.

- Calculation of profits to find out the income tax and sales tax gets easier.

Different Components of Accounting Voucher

In a manual payment scheme, as part of the control mechanism you find the following information on an accounting voucher:

- Identification number of the supplier

- The total amount to be paid

- The payable accounts in order to maintain a record of the liability

- The date on which the payment and transaction is made

- Any valid discounts for availing early payments (if any)

- The approved signature or the approved stamp

Benefits of Accounting Vouchers

- If you regularly update and maintain your accounting vouchers, you can avail the following advantages:

- The total number of cheques gets minimized since many invoices can be paid simultaneously.

- The separate approvals for each invoice payment make it simpler to plan and optimize productivity levels.

- Using vouchers can enable you to gain easier control over payment processing and manual transactions.

- The accounting vouchers are always numbered making the audit trail clear.

- The cashier who is in charge of the collection of all the invoices can report to the treasurer and display the invoices in a systematic manner.

Conclusion

Accounting vouchers are crucial for evidence of financial statements. They serve auditors as major support for recording the documentation of the purchase of goods and services. Maintaining accounting vouchers greatly diminishes the threat of employee theft and illegal stealing of the assets of a company.